Positive Money Mindset PLR Course 25k Words

in Make Money Online PLR Ebooks , Make Money PLR , Mindset PLR , PLR Checklists , PLR eBooks , PLR eCourses , PLR List Building Reports , Premium PLR , Premium PLR eBooks , Premium PLR Reports , Premium White Label Brandable PLR Coaching Courses , Private Label Rights ProductsChoose Your Desired Option(s)

has been added to your cart!

have been added to your cart!

#moneymindset #plrcourse #financialsuccess #wealthmindset #financialfreedom #moneymatters #mindsetshift #successhabits #moneymanagement

Help Your Audience Transform Their Financial Mindset and Unlock Abundance

Money is more than just numbers—it’s about mindset, beliefs, and habits. A person’s financial success isn’t just determined by income, but by how they think about and manage money. Many struggle with limiting beliefs, fear of financial risk, or negative associations with wealth, which hold them back from achieving real financial freedom.

The Positive Money Mindset PLR Course is designed to help individuals reframe their thoughts about money, develop better financial habits, and build confidence in managing their finances. Whether they are looking to break free from financial stress, improve their savings and investments, or grow their wealth with a prosperity-driven mindset, this course provides them with the essential tools to succeed.

And the best part? This course is completely done-for-you and ready to be rebranded, resold, and repurposed! If you are a finance coach, blogger, entrepreneur, course creator, or business owner, this high-quality PLR content gives you an in-demand digital product that you can start selling immediately.

Presenting…

Positive Money Mindset PLR Course 25k Words

Why Is This Course Valuable?

Most financial problems don’t come from not earning enough money—they come from poor financial habits, a scarcity mindset, and emotional barriers to wealth. This course helps individuals break free from those blocks and create a healthy, positive relationship with money.

With practical exercises, mindset shifts, and actionable strategies, this course guides learners step by step in transforming the way they think about and interact with money.

And for you, as the PLR buyer, this is a powerful and profitable niche to tap into! People are always looking for ways to improve their financial situation, develop a success mindset, and achieve financial independence.

What’s Inside the Positive Money Mindset PLR Course?

This course provides a comprehensive and structured approach to helping individuals develop a wealth mindset, financial confidence, and smart money habits.

Module 1: Foundations of a Positive Money Mindset

The journey to financial success starts with understanding and shifting core money beliefs. This module helps learners explore their money mindset, past financial experiences, and the emotional impact of money.

- Unpacking Your Money Story – How childhood experiences and societal conditioning shape money beliefs.

- Identifying Limiting Beliefs About Money – Recognizing thoughts that create financial blocks and replacing them with empowering affirmations.

- Shifting from Scarcity to Abundance Thinking – The difference between fear-based financial decisions and confidence-driven wealth-building.

- Practical Mindset Exercises – Journaling prompts and exercises to rewire the brain for financial success.

Module 2: Developing an Abundance Mindset

This module dives into how to think like wealthy, successful individuals and apply those thought patterns in real life.

- Overcoming Fear of Money & Financial Risk – Shifting from “money is hard to earn” to “money flows easily to me”.

- Recognizing Financial Opportunities – Developing a growth mindset to attract wealth, new income sources, and business opportunities.

- Shaping a Long-Term Vision for Wealth – Setting clear financial goals and aligning actions with a long-term strategy for success.

- Money and Self-Worth – Understanding how confidence and self-value impact earning potential.

Module 3: Practical Money Management Strategies

A positive money mindset must be supported by smart financial habits. This module teaches real-world money management techniques that help learners control their finances and build long-term stability.

- Budgeting with Confidence – How to create and stick to a budget without feeling restricted.

- Building Smart Spending Habits – How to spend money consciously while still enjoying life.

- The Psychology of Saving – How to shift from “saving is hard” to “saving is exciting”.

- Basic Investment Strategies for Beginners – How to start investing, grow wealth, and make financial decisions with confidence.

Module 4: Mastering Financial Conversations and Confidence

Money is a sensitive topic for many people, and communicating about it with confidence is an important skill. This module helps learners handle financial discussions, salary negotiations, and money-related decisions with ease.

- How to Talk About Money with Confidence – Shifting from awkward conversations to powerful financial discussions.

- Negotiating a Raise or Higher Fees – Strategies to increase earning potential without fear or hesitation.

- Handling Financial Setbacks Like a Pro – Bouncing back from financial mistakes, business losses, or unexpected challenges.

- Creating a Financial Success Circle – Surrounding oneself with positive, success-driven people to maintain motivation.

Module 5: Creating Long-Term Wealth and Financial Success

To sustain financial freedom and success, long-term habits must be developed. This module focuses on maintaining a wealth-building mindset and continuously improving financial literacy.

- Daily & Weekly Money Habits for Success – Small actions that lead to long-term financial security.

- Using Money to Create More Money – How successful people use money to create opportunities and build passive income.

- Embracing an Entrepreneurial Mindset – Shifting from just earning a paycheck to creating multiple streams of income.

- Financial Goal-Setting & Review Process – How to track financial progress and stay on course for success.

Who Can Benefit from This Course?

This PLR course is valuable for anyone looking to transform their financial situation and build a wealth mindset. It’s especially useful for:

- Entrepreneurs & Business Owners – Helping them develop smart financial habits and increase their earning potential.

- Coaches, Trainers & Money Mindset Experts – Giving them a done-for-you program to sell or use with clients.

- Finance Bloggers & Content Creators – Allowing them to turn this content into courses, digital products, and monetized blog posts.

- Individuals Struggling with Money Blocks – Providing them with a step-by-step system to shift their mindset and gain financial confidence.

How You Can Profit from This PLR Course

This high-value course is completely ready to sell and offers multiple ways to monetize:

- Sell It as an Online Course – Offer it on your website, course platform, or coaching program.

- Create a Membership Program – Turn this content into an exclusive financial success membership.

- Bundle It with Other Personal Finance Products – Sell it alongside budgeting planners, financial coaching, or business courses.

- Use It for Lead Generation – Offer sections of the course as free lead magnets to grow your email list.

- Turn It into an eBook or Workbook – Sell it on Amazon, Etsy, or your own store as a digital download.

- Create a Video Course or Podcast Series – Use the content to launch a paid video training program or podcast series.

What You Get in This PLR Package

- Full-Length Course (23,766 Words) – Professionally written, structured, and ready to use.

- Sales Page Copy (692 Words) – A done-for-you sales page to start selling instantly.

- Checklists & FAQs – Simple guides to enhance user experience.

- 100% Editable Content – Fully customizable to fit your brand and audience needs.

Start Selling & Profiting Today!

A positive money mindset is the foundation of wealth and success, and people are actively looking for guidance on transforming their financial habits.

This fully done-for-you PLR course allows you to tap into the personal finance niche, helping others while building your own profitable business.

Don’t wait—get your hands on this high-value PLR course today and start selling immediately!

has been added to your cart!

have been added to your cart!

Here A Sample of Positive Money Mindset PLR Course

Unlock a new way of thinking about money, and empower yourself to thrive financially and professionally in today’s fast-paced global economy.

Module 1: Foundations of a Positive Money Mindset

Lesson 1.1: Understanding Your Money Story

Step 1: Reflect on How Your Upbringing, Culture, and Experiences Have Shaped Your Thoughts About Money

Objective:

Gain clarity on how your personal background has influenced your current relationship with money.

Instructions:

1. Set the Scene

Take a moment to sit in a quiet place where you can focus without distractions. This step is about self-reflection, so let your thoughts flow naturally.

2. Explore Your Early Memories

Think back to your childhood and consider:

- Family Dynamics:

- Did your parents or guardians openly discuss money, or was it a private topic?

- How were spending, saving, or giving treated in your household?

- Did your parents or guardians openly discuss money, or was it a private topic?

- Cultural Influences:

- Was wealth viewed as a symbol of success, security, or something else?

- Were there sayings or beliefs about money in your community (e.g., “Money doesn’t grow on trees”)?

- Was wealth viewed as a symbol of success, security, or something else?

- Personal Experiences:

- When did you first earn or spend money on your own?

- Was there a moment when you felt proud, embarrassed, or anxious about money?

- When did you first earn or spend money on your own?

3. Write It Down

Take 5-10 minutes to jot down your reflections. You can use the following prompts to guide your writing:

- “A memory about money that stands out to me is…”

- “Growing up, I believed money was…”

- “My culture taught me to think of money as…”

- “One habit I noticed in my family around money was…”

4. Identify Patterns or Themes

Review what you’ve written. Ask yourself:

- Do I notice recurring ideas, such as money equals security or money is stressful?

- Are there specific beliefs that might still influence how I approach money in my career or personal life?

5. Share (Optional)

If you feel comfortable, discuss one key memory with a partner or the group. Use phrases like:

- “In my family, we believed…”

- “One moment that shaped my view on money was…”

- “I now see how this experience affects my current financial habits…”

Tips for Reflection:

- Be honest with yourself—there are no right or wrong answers.

- Keep an open mind; understanding is the first step to growth.

- If a memory feels negative, focus on how you’ve grown or could use it to improve your money mindset.

Example Reflection:

“When I was growing up, my family often said, ‘We can’t afford that,’ which made me think of money as something always in short supply. Now, I realize this belief has made me cautious with spending but also hesitant to invest in opportunities. I want to shift this mindset to see money as a tool for growth rather than a limitation.”

This exercise helps you uncover the root of your financial mindset, providing a strong foundation for reshaping your beliefs in a positive and empowering way.

Step 2: Journal About Your Earliest Memory of Money

Objective:

Reflect on a specific money-related memory from your past to uncover how it influences your current financial decisions and mindset.

Instructions:

1. Set Aside Time to Journal

- Find a comfortable, quiet spot where you can write without interruptions.

- Use a notebook, a digital journal, or even a blank piece of paper to capture your thoughts.

2. Recall Your Earliest Money Memory

Take a moment to reflect on your childhood. Think about the first time money became meaningful to you.

- Prompts to Spark Your Memory:

- Did you receive an allowance, gift, or reward for a chore?

- Was there a moment when you spent money on something special?

- Were you ever told “We can’t afford this” or taught to save money early on?

- Did you receive an allowance, gift, or reward for a chore?

3. Describe the Experience

Write freely about the memory, focusing on the details:

- What Happened?

- Where were you? Who was involved? What was the situation?

- Example: “I remember being 7 years old, standing at a toy store with my parents, wanting a doll I couldn’t have.”

- Where were you? Who was involved? What was the situation?

- How Did You Feel?

- Were you excited, proud, disappointed, or confused?

- Example: “I felt embarrassed because we couldn’t afford it, and I didn’t understand why.”

4. Reflect on the Memory’s Impact Today

Consider how this memory has shaped your financial habits, mindset, or decisions in adulthood.

- Questions to Answer:

- Do you avoid spending or overindulge because of this experience?

- Are you cautious, confident, or hesitant with money because of what you learned?

- Example: “This memory made me hesitant to spend money on myself, even when I can afford it. I still feel guilty about buying things I want.”

- Do you avoid spending or overindulge because of this experience?

5. Frame It as a Lesson

- End your journal entry with a positive takeaway or insight.

- Example: “I now realize that money is a tool, not a measure of my worth, and I’m working to feel confident in my spending decisions.”

Sample Journal Entry:

“My earliest memory of money was when my parents gave me ₹10 for helping clean the house. I was so excited to buy candy with it, but my father asked if I wanted to save it instead. At the time, I felt confused—I thought money was for spending! This shaped my belief that saving is more important than enjoying money. Today, I still struggle to spend on myself, even for things I need. I’m learning to balance saving with enjoying what I earn.”

Tips for Effective Journaling:

- Write honestly—this is for your growth, not for anyone else to judge.

- Focus on details that stand out; they often hold the most meaning.

- Be open to exploring both positive and negative feelings.

Journaling helps you uncover the hidden connections between your past experiences and current financial habits. By reflecting on these moments, you’ll gain clarity and begin the journey toward a healthier money mindset.

Step 3: Discuss in Pairs or Small Groups the Similarities and Differences in Money Stories

Objective:

Share your money story with others, identify common themes, and practice professional communication skills to articulate your experiences clearly and confidently.

Instructions:

1. Partner Up or Form Small Groups

- Work with a partner or in groups of 3-4 people.

- Each person will take a turn sharing their money story, focusing on a specific memory and its impact on their mindset today.

2. Share Your Money Story

When it’s your turn to speak:

- Use a conversational tone and share openly.

- Structure your story:

- “My earliest money memory was…”

- “This made me feel…”

- “I realized that this experience taught me…”

- “Today, I see how it impacts…”

- “My earliest money memory was…”

Example Phrases to Use:

- “In my experience, money was always a source of stress in my family, so I grew up thinking I had to save everything.”

- “I realized that my cultural background taught me to value hard work over material wealth.”

- “Because of this, I now approach financial decisions with…”

3. Actively Listen and Acknowledge

When others share:

- Show engagement by nodding, maintaining eye contact, and asking clarifying questions.

- Use phrases to acknowledge their story, such as:

- “That’s interesting! I never thought about it that way.”

- “I can relate to that because…”

- “It’s amazing how our experiences shape us so differently.”

- “That’s interesting! I never thought about it that way.”

4. Compare Similarities and Differences

After everyone has shared, discuss common themes and unique perspectives:

- What beliefs or experiences seem to overlap?

- Example: “It sounds like many of us learned about saving at a young age.”

- Example: “It sounds like many of us learned about saving at a young age.”

- What differences stood out?

- Example: “Your story about money being openly discussed in your family is so different from my experience.”

Example Phrases to Facilitate Comparison:

- “I noticed that we both…”

- “It’s interesting how our families handled money so differently—your story made me think about…”

- “I hadn’t realized that cultural background plays such a big role in shaping beliefs.”

5. Wrap Up with Insights

- Share one takeaway or insight from the discussion.

- “Hearing everyone’s stories helped me realize that I’m not alone in feeling cautious about spending.”

- “I’ve learned that changing my money mindset is possible because others have done it too.”

- “Hearing everyone’s stories helped me realize that I’m not alone in feeling cautious about spending.”

- Write down one idea or belief from the discussion that inspires you to approach money differently.

Tips for a Productive Discussion:

- Be respectful and nonjudgmental—everyone’s story is valid.

- Focus on learning from each other, not comparing outcomes.

- Use clear and professional language to express your thoughts.

Outcome:

This exercise not only deepens your understanding of how money stories vary but also strengthens your ability to articulate experiences confidently and empathetically in professional settings.

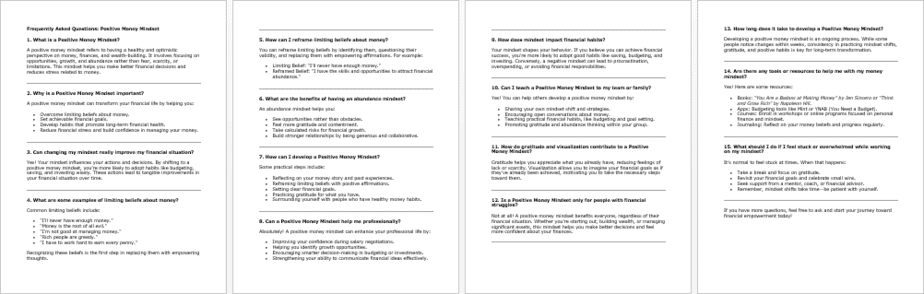

We’re also giving these extra bonuses

Positive Money Mindset – Checklist

Positive Money Mindset – FAQs

Positive Money Mindset – Salespage Content

Package Details:

Word Count: 23 766 Words

Number of Pages: 192

Positive Money Mindset – Bonus Content

Checklist

Word Count: 413 words

FAQs

Word Count: 775 words

Salespage Content

Word Count: 692 words

Total Word Count: 44 014 Words

Your PLR License Terms

PERMISSIONS: What Can You Do With These Materials?

Sell the content basically as it is (with some minor tweaks to make it “yours”).

If you are going to claim copyright to anything created with this content, then you must substantially change at 75% of the content to distinguish yourself from other licensees.

Break up the content into small portions to sell as individual reports for $10-$20 each.

Bundle the content with other existing content to create larger products for $47-$97 each.

Setup your own membership site with the content and generate monthly residual payments!

Take the content and convert it into a multiple-week “eclass” that you charge $297-$497 to access!

Use the content to create a “physical” product that you sell for premium prices!

Convert it to audios, videos, membership site content and more.

Excerpt and / or edit portions of the content to give away for free as blog posts, reports, etc. to use as lead magnets, incentives and more!

Create your own original product from it, set it up at a site and “flip” the site for megabucks!

RESTRICTIONS: What Can’t You Do With These Materials?

To protect the value of these products, you may not pass on the rights to your customers. This means that your customers may not have PLR rights or reprint / resell rights passed on to them.

You may not pass on any kind of licensing (PLR, reprint / resell, etc.) to ANY offer created from ANY PORTION OF this content that would allow additional people to sell or give away any portion of the content contained in this package.

You may not offer 100% commission to affiliates selling your version / copy of this product. The maximum affiliate commission you may pay out for offers created that include parts of this content is 75%.

You are not permitted to give the complete materials away in their current state for free – they must be sold. They must be excerpted and / or edited to be given away, unless otherwise noted. Example: You ARE permitted to excerpt portions of content for blog posts, lead magnets, etc.

You may not add this content to any part of an existing customer order that would not require them to make an additional purchase. (IE You cannot add it to a package, membership site, etc. that customers have ALREADY paid for.)

Related Products That May Interest You

Share Now!